The Challenge: A Structural Budget Gap and Limited Revenue Options

The City of Kirkland, WA knew its budget was on an unsustainable path. Like many cities, it faced the looming expiration of pandemic-related state and federal funding streams, coupled with cost inflation and ongoing social-service and infrastructure spending needs. The City wanted to address these issues in a way that increased fiscal resilience while limiting the financial impact on lower-income residents. To gain insight into its options, the City contracted ECONorthwest.

“Kirkland—like most local governments—is limited by statute in its options to increase, restructure, or adjust taxes, but cities generally have more flexibility to improve fee structures. The recommended revenue options met the City’s priority goals of financial sustainability and equity.”

The Solution: Revenue Options that Prioritize Equity

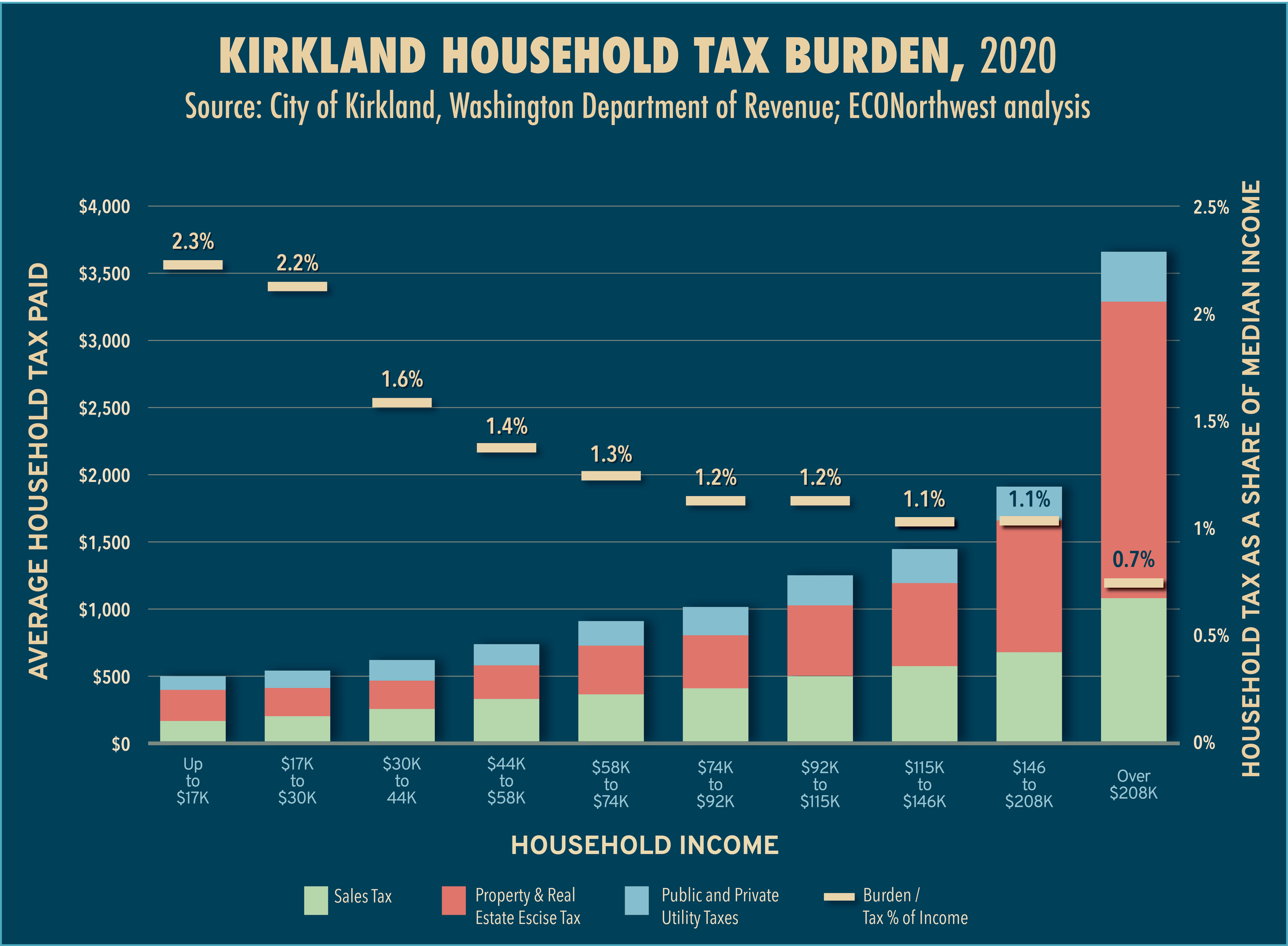

ECONorthwest’s analysis of revenue options began with a careful look at the City’s existing tax structure. We found that, like most cities, Kirkland derives much of its total revenue from high-income earners. At the same time, the tax burden is three times higher for the city’s lowest-income residents. For example, the 2500 Kirkland households earning less than $30,000 per year pay about 2.2% ($660) of their incomes toward taxes, income that would otherwise be used for rent, childcare, or other daily necessities.

ECONorthwest’s analysis of revenue options began with a careful look at the City’s existing tax structure. We found that, like most cities, Kirkland derives much of its total revenue from high-income earners. At the same time, the tax burden is three times higher for the city’s lowest-income residents. For example, the 2500 Kirkland households earning less than $30,000 per year pay about 2.2% ($660) of their incomes toward taxes, income that would otherwise be used for rent, childcare, or other daily necessities.

Kirkland asked ECO to analyze eight potential revenue sources, rating each on a five-element matrix that would help make policy choices consistent with the City’s goals.

The City was interested in finding options that ranked highly in:

ECO’s Recommendations

ECO found three options that scored highly. These options collectively increased revenue by about $9.3 million dollars, and all scored highly on an assessment of revenue stability (revenue amounts derived from the source do not vary as much from year to year) and equity (the revenue source does not increase the tax burden for lower-income residents):

- Increase the City’s business license fees, exempting small businesses.

Implement a new “REET for Street” program which would allow the City to use some increased property tax funds to improve road quality and safety.

Implement a new “REET for Street” program which would allow the City to use some increased property tax funds to improve road quality and safety.- Expand paid parking in the busy downtown area.

- Even with these new or increased revenue sources, Kirkland may not be able to fully address its budget deficit. The City will likely need to consider a new local option levy to completely close the gap. The good news is that the recommended options allow the City to begin generating needed revenue quickly, without further increasing the tax burden on lower-income households.